Liquidity protocol for leverage trading of all on-chain assets.

A DeFi prime brokerage where lenders fund traders on spot margin — built for any token.

.svg)

.svg)

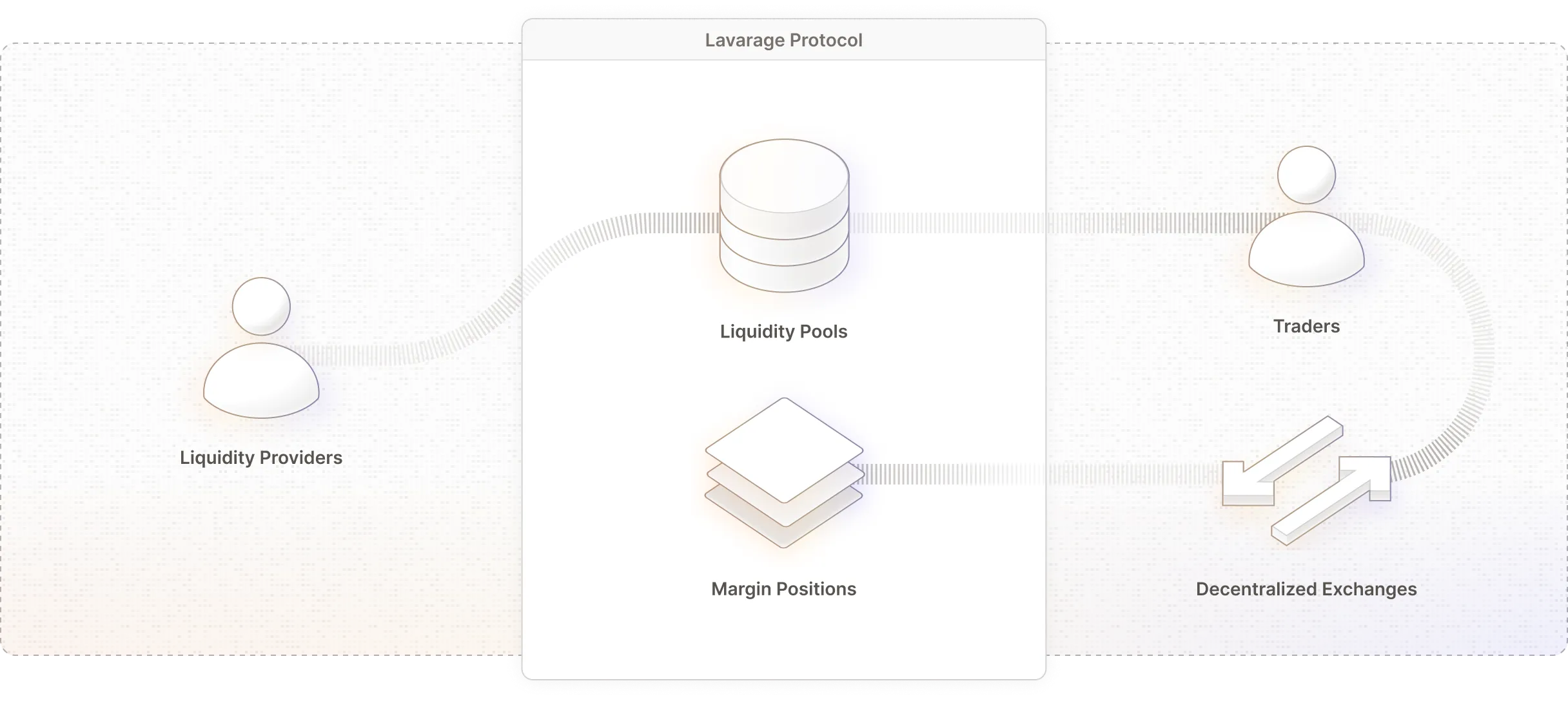

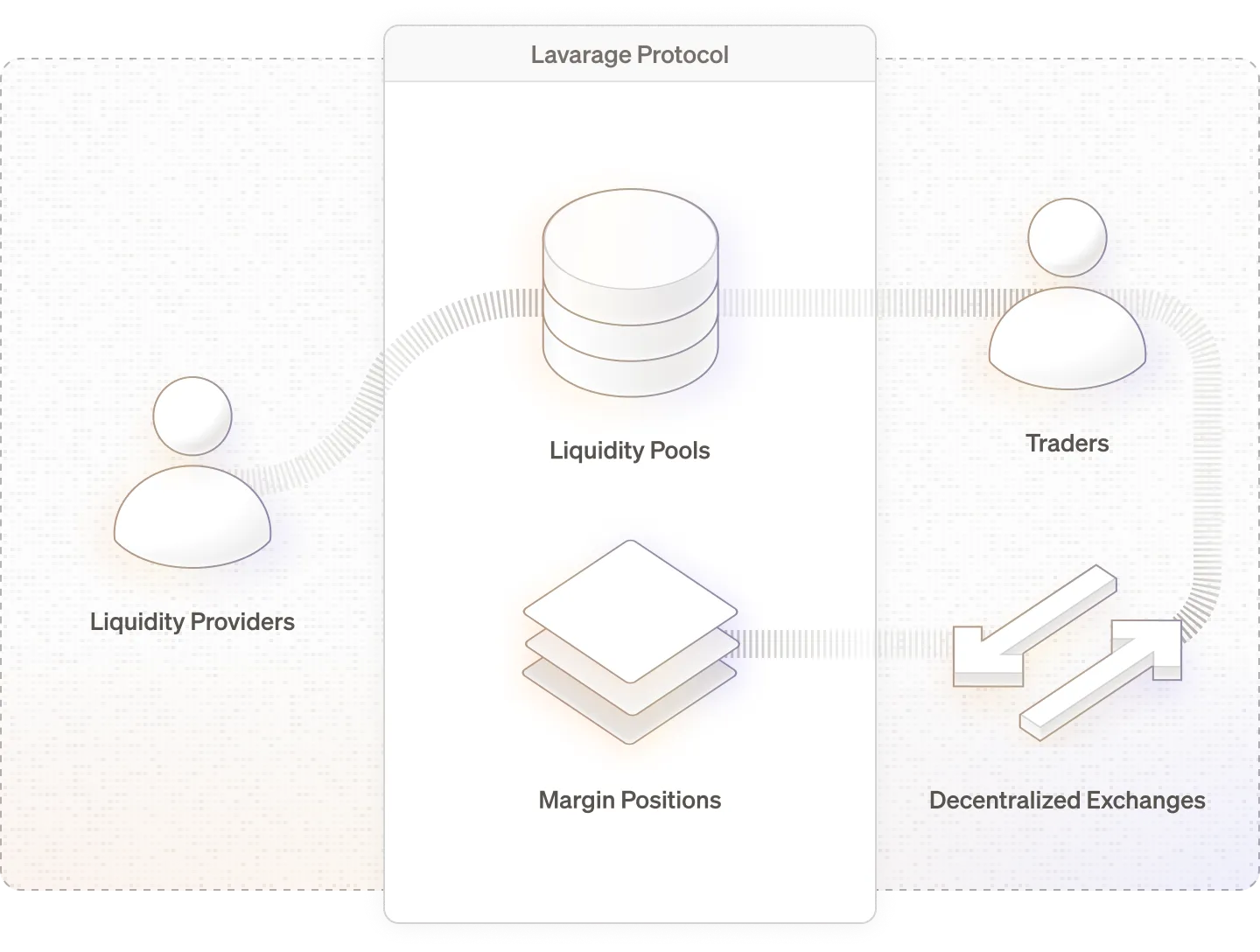

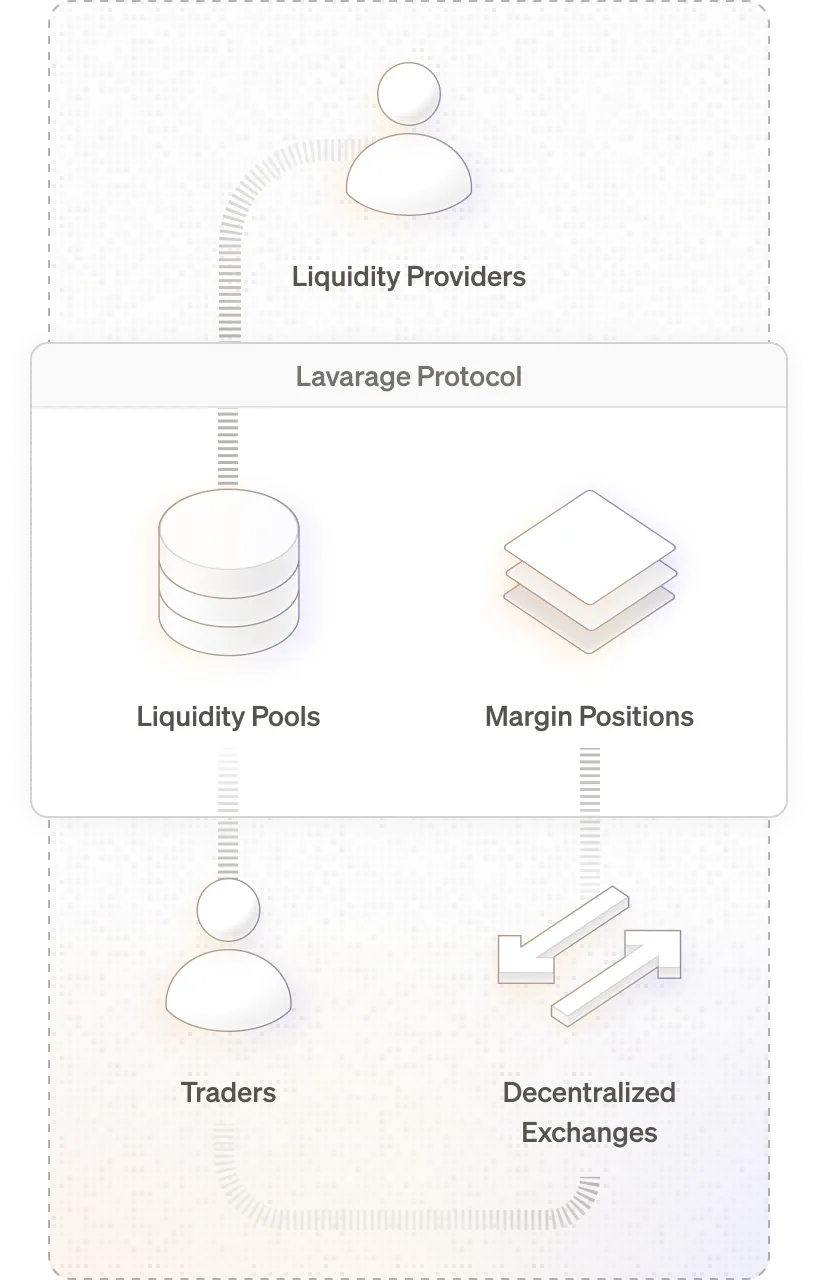

Connecting capital from liquidity providers to on-chain traders.

Lavarage is a lending and borrowing protocol built specifically to facilitate permissionless on-chain spot margin positions.

Liquidity Providers

Liquidity Providers

Liquidity Providers

Liquidity Providers

Liquidity Providers

.svg)

Provide liquidity, your way.

Choose how you want to participate — as an active lender with full control, or a passive staker earning yield.

Take control of your capital

Set loan terms to capture opportunities and manage risks

Control whether to allow others to stake into your pools

Ideal for active lenders and token projects

Interest from loans

Profit from liquidation

Earn passively

Browse and stake/unstake freely across pools

No need to manage loan terms

Suitable for passive whales or retails

Share interest from the pool(s)

Downside protection (in normal cases)

Power your DeFi platform with LavaOS — integrate on-chain leverage with ease.

A plug-and-play API for seamless access to Lavarage's on-chain spot margin infrastructure and liquidity pools.

Launch leverage trading in weeks, not months. One API handles everything.

Earn from day one. Set your fees, get paid instantly on-chain.

Full-service partnership: integration support, co-marketing, continuous upgrades.

All transactions run in audited smart contracts and are independently verifiable on-chain.

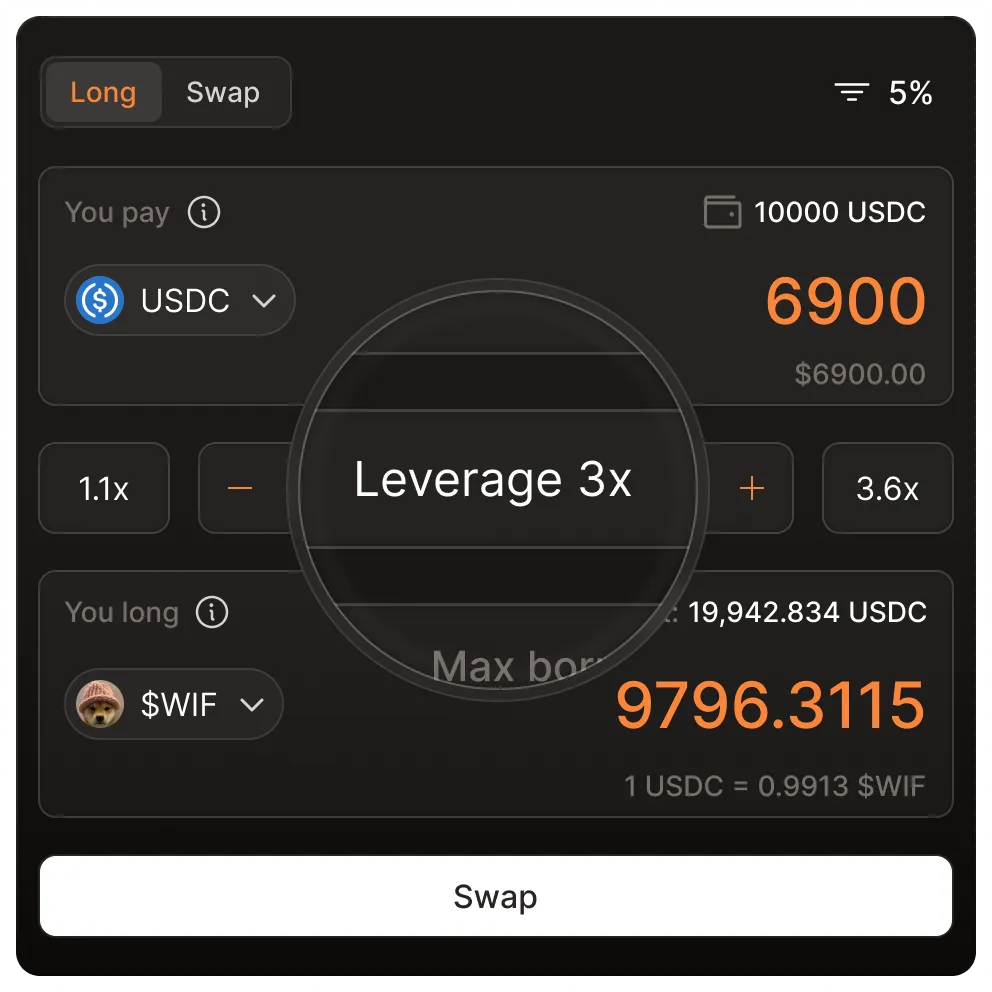

First to leverage. Unlock greater potential.

Leverage trading on all tokens, including the newest launches. Decentralized and fully on-chain.

Secure and proven at scale

2024

59,256

152M

7,758

2,580

5

Questions, answered.

Have a question that wasn’t answered? Don’t hesitate to get in touch — we’re here to help.

Is Lavarage a DEX?

No, we're more than a DEX—we're the liquidity protocol for leverage trading of all on-chain assets.

Lavarage is a two-sided liquidity protocol connecting lenders who supply capital with traders who need leverage for on-chain assets. We provide the lending rails and margin mechanics that enable up to 4x leverage on any Jupiter-supported token, while trades execute on Raydium, Orca, or any Solana DEX. Think of us as the leverage layer for all of DeFi, making every on-chain asset tradeable with leverage.

Why do Lavarage’s staking and lending pools yield so much higher than traditional SOL and USDC staking?

Our stakers earn significantly higher than market rates because traders on Lavarage are short-term players chasing volatile long-tail assets like newly launched memecoins. They're looking to get in early with leverage to capture massive upside, and many of these opportunities are only available on Lavarage. When someone's hunting for exponential returns in days, they'll gladly pay premium borrowing costs. It's simple: high-volatility opportunities command high-value liquidity.

Who will use my liquidity when I lend?

Your liquidity powers the entire Lavarage ecosystem, including our flagship dApp and all of our integration partners building on top of our Lavarage On-chain Stack (LavaOS).

You're not waiting for borrowers; there's already proven demand from 7,000+ traders who've opened 50,000+ positions across 2,300+ assets.

Why use Lavarage for leverage trading instead of CEXs or perps?

Get leverage on tokens the moment they launch. No waiting for CEX listings or perp markets to open. Trade 2,300+ Solana assets with up to 4x leverage, fully on-chain and non-custodial. We're the only protocol purpose-built for margin trading long-tail assets where the real alpha lives.

Also, we are supporting spot margin trading, which means you are trading the exact tokens on-chain with the true market price on DEXs. You also have the choice to take delivery of the spot tokens, something you can't do with perps. We offer seamless leverage with automated risk management, liquidation protection at 90% LTV, and purpose-built infrastructure for short-term, high-conviction trades.

Can I integrate Lavarage's leverage trading into my own platform?

Yes! LavaOS powers leverage trading for 4 white-label platforms (and growing) already. Launch your own branded leverage trading experience in just 2 weeks, earn fee share on every transaction, and tap into our deep liquidity pools. We handle the infrastructure; you keep your users and brand.

.svg)